Over the last tumultuous year, the Accounting and Financial Services industry has largely withstood impacts from the global pandemic, an election cycle, and waves of social change. Some firms have thrived and others have been more challenged, but one thing that remains consistent is that firms have taken this opportunity to reexamine all aspects of their business.

The Hinge Research Institute’s newly released analysis of the Accounting and Financial Services segment of the 2021 High Growth Study reflects these trends. The report first looks at overall industry trends within the larger context of the general professional services industry. It then continues on to compare the fastest growing accounting and financial services firms (those having a compound annual growth rate of 20% or greater over a three-year assessment period) with their slower, no growth peers.

Purchase the 2021 High Growth Study: Accounting & Financial Services Edition

About the Study

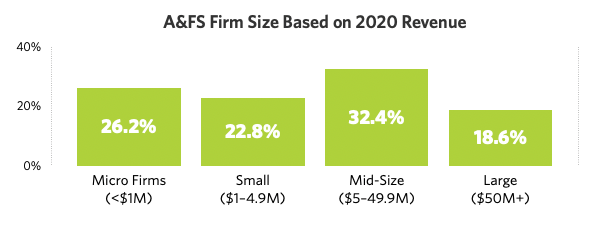

The analysis looked at over 170 firms with a combined revenue of over $100 billion and 160,000 employees. The sample was representative of firms of all sizes.

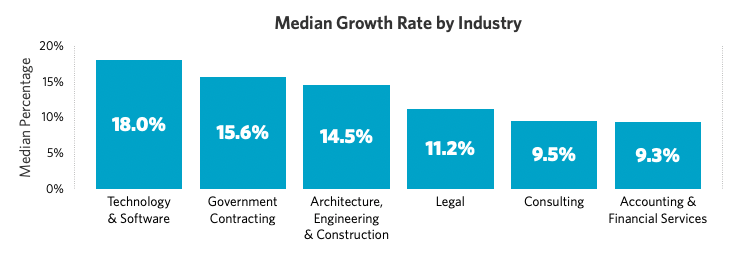

Unfortunately, the Accounting and Financial Services industry as a whole is lagging all other professional services industries in terms of overall revenue growth.

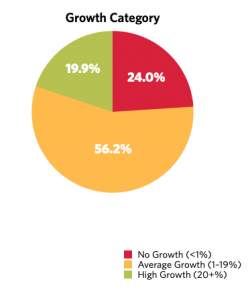

But the analysis offers clear insights into how some firms are successfully navigating the dynamic and rapidly changing environment, at least in part due to how they are approaching marketing and business development. High Growth firms are defined as having a compound annual growth rate of 20% or greater over a three-year period. About 20% of A&FS firms in this year’s study meet this criteria—down from 2019 (26%). On the other end, the No Growth category was up sharply—from 10% last year to 24% this year.

Understanding what these firms are doing differently is instructive to a better way forward. The following are some of the high-level insights.

Key Findings

For Accounting and Financial Services Firms, Business and Competition are Now Both Virtual and Global

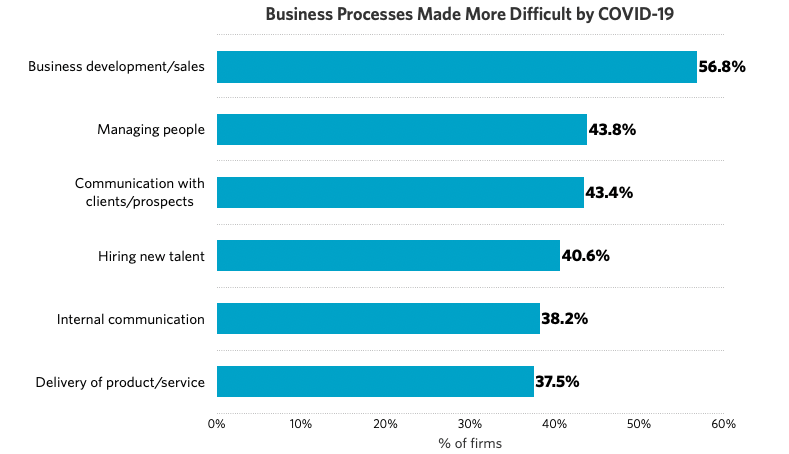

Accounting and financial services have long been considered inherently local in nature. However, that is the case no more. Covid-19 has required almost every firm to learn how to develop business, serve clients, and manage talent remotely. While this adjustment to “normal operating procedure” has not been without difficulty, many firms have been able to learn ways to cope with a new and shifting marketplace.

Marketing and business development in a virtual world are new experiences for many firms. For those that have been doing it for years, what they have learned is that buyers are looking for firms that understand their industry and business issues and have the expertise to solve their problem. In a global and digital world, this means firms are exposed to a whole new set of competitors and opportunities.

High Growth Accounting and Financial Services Firms Use Research to Reduce Risk

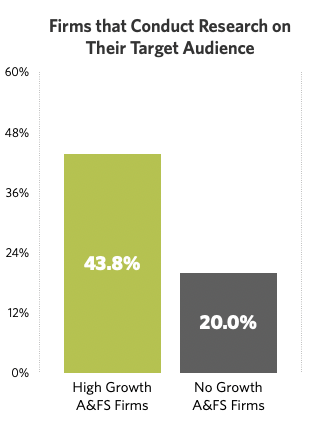

Accounting and financial services firms that conduct research on their target audience grow faster and are more profitable. Why? First, in a world marked by unpredictability and disruption, research provides the insight to connect with your clients’ and prospects’ key issues and evolving concerns. The firm that has the best, most up-to-date understanding of their target market’s needs and priorities, has a very real competitive advantage. Think of it as accelerating the learning curve. Regular research reduces risk.

Second, original research on a target audience is one of the most powerful forms of high value content. Firms are eager to learn of trends and research supported insights in their industries, and sharing the results of your research turns out to be a great way to attract potential clients, while demonstrating your expertise. These insights can be delivered via a wide variety of marketing channels, from social media to trade publications and webinars, making it an exceptionally convenient and effective core of a content marketing program.

High Growth Accounting and Financial Services Firms Are All In On Digital

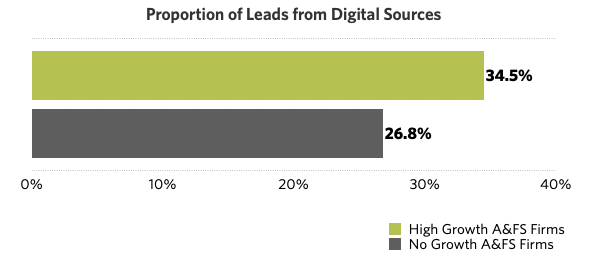

There has been a decade-long trend of accounting and financial services firm buyers using digital channels to research important business issues, find, and evaluate service providers. The pandemic has accelerated this digital adoption to compensate for decreased face-to-face interaction. If there was still any question, consider that the proportion of new business leads generated from digital sources (e.g., website, email, social media, digital advertising) surged by 30% in the last year.

Additionally, High Growth firms show us that increasing digital leads is integral to their success. They are getting about 30% more leads from digital sources than their No Growth peers.

What’s more, nearly 29% of them are actually increasing their marketing budgets and spending it on digital tools and techniques, rather than more traditional avenues.

For firms that have been digital laggards, it is time to embrace modern marketing, even if only for defensive purposes. The best time to invest is when your competitors are pulling back and a firm with a weak digital strategy this year, could easily find itself in the No Growth column next year.

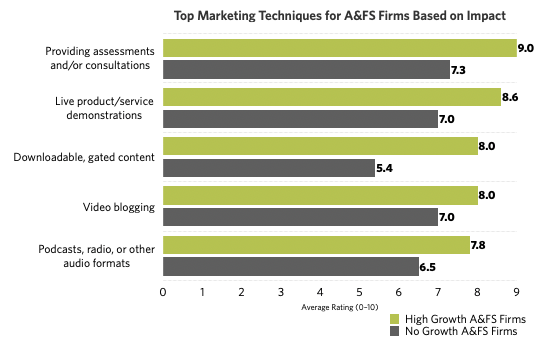

High Growth Accounting and Financial Services Firms See More Impact From Techniques that Demonstrate Their Expertise

How do you make your insight and expertise visible in a virtual world? The answer: by using the very techniques that the High Growth firms use. From writing to presenting to networking, firms have found effective ways to express and promote their competitive advantage.

See the Full Results. Purchase the 2021 High Growth Study: Accounting & Financial Services Edition

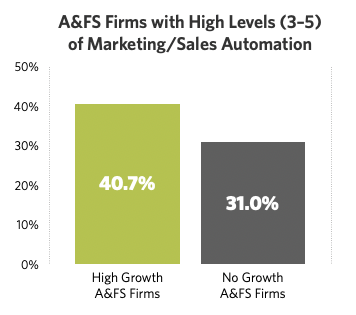

High Growth firms have different marketing priorities than their No Growth peers, and they also see more impact from the techniques they use. But the areas where we observed the greatest disparity is in application of more sophisticated technologies such as marketing/sales automation. High Growth firms are not only much more likely to have marketing/sales automation in place (85% vs. 69%), they are more likely to use it in a more sophisticated way. When automation maturity was assessed on a 6-point scale, the High Growth firms were much more likely (40.7% vs. 31%) to be in the top three levels of maturity.

High Growth firms are leaning into change and exploring digital strategies to better serve their target clients as they plan for an evolving marketplace. And this trend doesn’t only impact marketing automation.

High Growth Firms Have More Mature Automation Strategies for Core Business Software

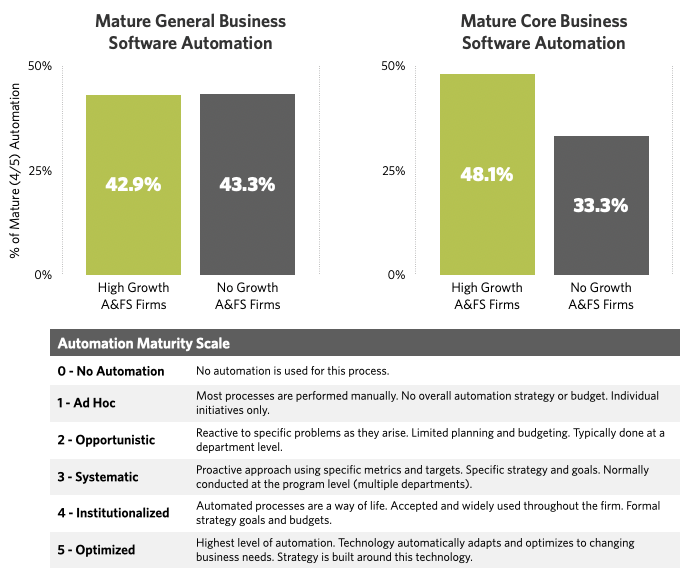

In addition to marketing/sales automation adoption, we looked at the automation maturity (levels 4 and 5 of our Automation Maturity Scale) for both general business software (word processing, spreadsheets, etc.) and core business process automation (associated with the specialized work accounting and financial services do).

What we found was that High Growth firms are much more mature in the automation of their core business processes than their No Growth peers and there was little difference in their automation of general business software. This is a wake up call. Clearly, High Growth firms are leveraging core business process automation and in order to stay competitive, firms will need to commit to upgrading their automation maturity.

High Growth Accounting and Financial Services Firms are Embracing the Virtual Workplace

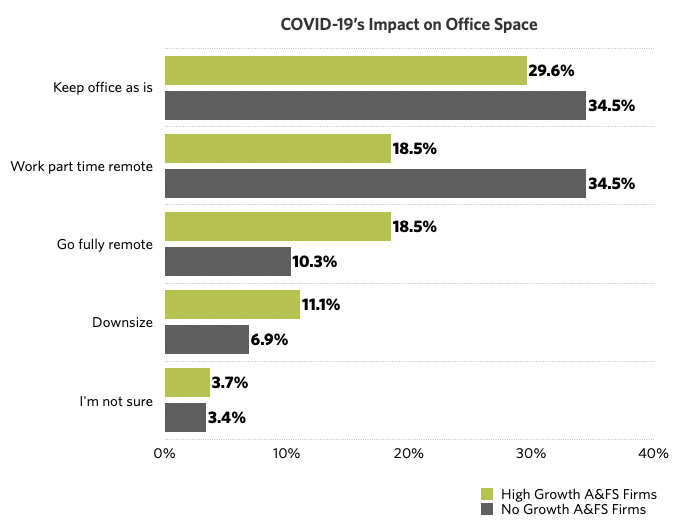

When we get to the other side of Covid-19, will the workplace ever be the same? Probably not. The trend to remote work and all that entails did not start this year. But it certainly has accelerated and introduced the concept to firms that never considered it before.

Just as digital marketing and business development has changed the way we attract new clients, virtual work has had a parallel effect on the way we will recruit and manage professionals in the future. Going forward, the best talent is likely to demand a flexible, remote (or part remote) work environment.

It’s no surprise then that High Growth accounting and financial services firms are already thinking ahead of the curve. The analysis found that they are nearly twice as likely to say goodbye to the office and go fully remote, and only 30% indicated that they do not anticipate a change in their office space requirements. Conversely, No Growth firms are more likely to introduce part-time remote options or make no changes to their office space requirements.

The Bottom Line

In this time of great uncertainty and a rapidly evolving marketplace, it is tempting to freeze in place and avoid making big decisions or changes to your marketing strategy. And while it may be tempting, it is undoubtedly a mistake.

The firms that adapt the fastest will gain a competitive advantage. The shift towards digital is well established and many accounting and financial services firms are pulling ahead of their No Growth competitors by following their clients online and making their expertise visible. Likewise, re-examining other important business processes like developing business and delivering services in a virtual environment for the long-term is going to be important as top talent will inevitably be demanding more flexible work arrangements. Now is the perfect time to learn from the firms that are leading the way.

Additional Resources

Want to see the full results of the 2021 High Growth Study: Accounting & Financial Services Edition? Purchase the full report here.